Everything You Need to Know About Professional Liability Insurance

What Does Professional Liability Insurance Cover?

Professional liability insurance helps cover claims of:

- Negligence

- Misrepresentation

- Inaccurate communication

Even if y'all didn't exercise annihilation wrong, your client tin nonetheless sue your business if they believe yous made a mistake. Without coverage, yous'll take to pay expensive legal defence costs out of pocket.

It's important to think that professional liability insurance doesn't cover everything. For example, it won't assistance your business organization with these kinds of claims:

- Actual injury or holding damage: Yous'll want to get a general liability insurance policy to help cover your costs if someone is injured on your business premises or you harm another's property.

- Piece of work-related injuries or illnesses: If your employees get injure or sick from their task, you'll need a workers' compensation insurance policy to help them recover and render to work.

- Data breach: You'll need cyber insurance if your business loses confidential or sensitive data virtually your clients and customers.

How Professional Liability Insurance Works

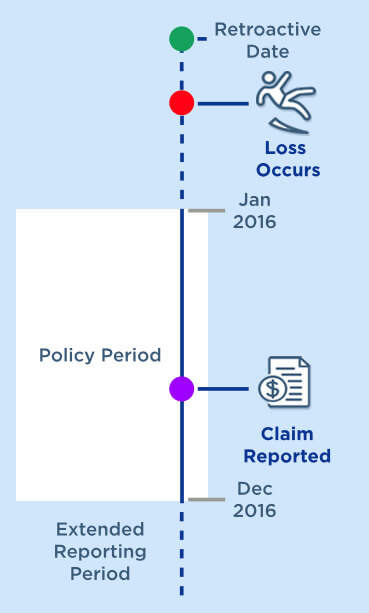

Many insurance companies write a professional liability insurance policy on a claims-made basis with a retroactive appointment and extended reporting menstruum.

The retroactive date means you're covered for incidents that happen on or after a specified date in your policy.

The extended reporting menstruum helps encompass claims filed inside a sure time after your policy expires. This is generally a thirty- to 60-twenty-four hours flow, only yous can extend this period to a twelvemonth or more for an additional price.

Your insurance company just covers claims made against your business during your policy menstruum or within the extended reporting menstruum. And the claim must exist from a covered error or omission that happened later your policy's retroactive appointment.

CLAIMS-Made Example

Since the claim was reported during the policy menstruum and the loss occurred subsequently the retroactive appointment, it would exist eligible for coverage under a claims-made policy.

If a merits is brought after the policy's expiration, it tin get coverage if information technology's reported within the extended reporting catamenia.

Who Needs Professional Liability Insurance?

Many types of businesses demand professional liability insurance. Some states crave this type of business organization insurance. In others, business owners choose to go coverage in case a client or customer sues them.

You'll want to get a professional liability insurance policy if y'all:

- Accept to sign a contract that requires you lot to bear coverage

- Offer professional services direct to customers

- Regularly give advice to your clients

Run into Jane, an Interior Designer

For Jane, the best part of existence an interior designer is showing off the infinite she's created. Recently, a client'due south custom furniture didn't fit and now Jane is being sued. Luckily, Jane has a business possessor'south policy with professional liability insurance which helped pay for her legal fees.

Many small business owners don't realize the big benefits of adding this coverage to their business owner's policy.

To learn more virtually professional person liability insurance, get a quote from us today.

How Much Does Professional Liability Insurance Cost?

Your professional person liability insurance cost is unique to your business concern. Factors that can impact your errors and omissions insurance cost include:

- Policy details, like coverage limits

- Blazon of business

- Location

- Business size, number of employees and clients

- Years in business

- Claims history

When you're ready to get a quote, it's a good idea to have important business organization documents on paw, such equally:

- Copies of contracts

- Documentation procedures

- Any information about previous errors and omissions coverage

- Quality control processes

- Employee training initiatives

Work with our specialists to get the right corporeality of coverage for your business at the right price. We're backed by over 200 years of experience and we help protect businesses in many industries with professional liability insurance.

The Hartford shall not be liable for whatever damages in connection with the use of any information provided on this page. Please consult with your insurance agent/banker or insurance company to determine specific coverage needs as this information is intended to exist educational in nature.

The data contained on this page should not be construed as specific legal, Hr, fiscal, or insurance advice and is not a guarantee of coverage. In the outcome of a loss or merits, coverage determinations volition be discipline to the policy language, and any potential claim payment will exist determined following a claim investigation.

Certain coverages vary by state and may not be available to all businesses. All Hartford coverages and services described on this page may exist offered past one or more than of the belongings and casualty insurance visitor subsidiaries of The Hartford Financial Services Grouping, Inc. In TX, this insurance is written past Picket Insurance Company, Ltd., Hartford Casualty Insurance Visitor, Hartford Lloyd'south Insurance Company, Property and Casualty Insurance Company of Hartford, Hartford Underwriters Insurance Company, Twin City Fire Insurance Company, Hartford Accident and Indemnity Visitor and Hartford Fire Insurance Company. In Arizona, New Hampshire, Washington and California, the insurance is underwritten by Hartford Accident and Indemnity Visitor, Hartford Casualty Insurance Company, Hartford Burn Insurance Company, Hartford Insurance Visitor of Illinois, Hartford Insurance Company of the Midwest, Hartford Lloyd's Insurance Visitor, Hartford Underwriters Insurance Visitor, Maxum Prey Insurance Company, Maxum Indemnity Company, Navigators Insurance Visitor, Navigators Specialty Insurance Visitor, Pacific Insurance Company, Property and Prey Insurance Visitor of Hartford, Sentinel Insurance Company, Ltd., Trumbull Insurance Visitor and Twin Metropolis Fire Insurance Company. The Hartford® is The Hartford Financial Services Group, Inc. and its subsidiaries, including Hartford Fire Insurance Visitor.

The Hartford® is The Hartford Financial Services Group, Inc. and its belongings and casualty subsidiaries, including Hartford Fire Insurance Company. Its headquarters is in Hartford, CT.

* Client reviews are collected and tabulated by The Hartford and not representative of all customers.

Get a Professional Liability Quote

mitchellnortrinter.blogspot.com

Source: https://www.thehartford.com/professional-liability-insurance

0 Response to "Everything You Need to Know About Professional Liability Insurance"

Post a Comment